You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

ABF | Central States Pension Contributions

- Thread starter dokman

- Start date

Steward of the Rock

TB Veteran

- Credits

- 734

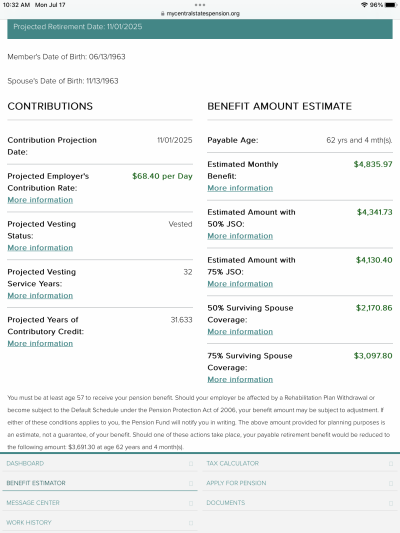

Central States Pension has been frozen since 2013 at $68.40 per day worked or compensated up to $342.00 a week (5-days).What is rate under new contract. Trying to get on at ABF and would like information.

Any help would be appreciated.

Thanks

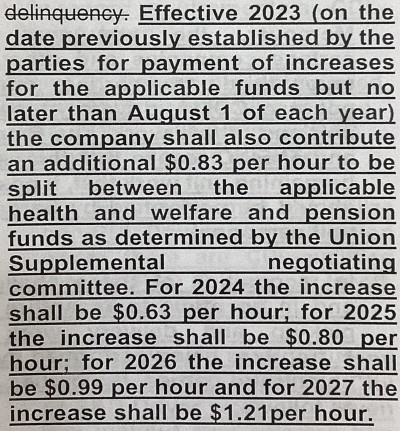

All the contractual Pension/H&W increases have gone to the H&W fund since 2013 to keep it fully funded. Below is the increases to the Pension/H&W funds for our new contract. I am sure it will all go to the H&W fund as it has the past ten years.

Last edited:

- Credits

- 584

Always hated that word split!!!Central States Pension has been frozen since 2013 at $68.40 per day worked or compensated up to $342.00 a week (5-days).

All the contractual Pension/H&W increases have gone to the H&W fund since 2013 to keep it fully funded. Below is the increases to the Pension/H&W funds for our new contract. I am sure it will all go to the H&W fund as it has the past ten years.

Thanks for the info.Central States Pension has been frozen since 2013 at $68.40 per day worked or compensated up to $342.00 a week (5-days).

All the contractual Pension/H&W increases have gone to the H&W fund since 2013 to keep it fully funded. Below is the increases to the Pension/H&W funds for our new contract. I am sure it will all go to the H&W fund as it has the past ten years.

Steward of the Rock

TB Veteran

- Credits

- 734

And yet we spend a life time chasing it!!!Always hated that word split!!!

- Credits

- 584

Nothing beats spending time at the Y!!!And yet we spend a life time chasing it!!!

Catching it is more satisfying than chasing it, although the chase can be exciting.And yet we spend a life time chasing it!!!

Steward of the Rock

TB Veteran

- Credits

- 734

I guess I should have finished explaining how the pension works in Central States, so here it goes.What is rate under new contract. Trying to get on at ABF and would like information.

Any help would be appreciated.

Thanks

What ever amount is contributed for the calendar year (Jan. 1 thru Dec.31) in your behalf will give you 1% of that total per month when you retire.

So, if you have the maximum contribution credits for that calendar year (52-weeks X 5-days a week = 260-days), you would multiply that total by $68.40 (daily contribution rate). That total would be $17,784.00 for that calendar year. So, 1% of that would give you $177.84 a month for that year when you retire. Ten years at that rate would be $1778.40 a month, twenty would be $3556.80 a month, etc., etc…….

**You must have five full contributory years to be vested to get anything.

**You must have at least 90-days credit in a calendar year (I think it is) to get anything for that calendar year.

**You must be 62 or older to draw the full amount. Provided you have at least 20-years in, you can retire as early as 57- years old. But every year you are short of age 62 is a 6% penalty. So if you retired at 57-years old, you would only draw 70% of the maximum.

If you have any other questions, feel free to ask and I will try to answer them my friend!!!

Steward of the Rock

TB Veteran

- Credits

- 734

You are going to have to work another 30 years to pay to feed Bertha and Puddin....

Thanks for all the information . Your years of service and age are very close to mine, only exception at age 62 I will have a few more years of contributory and vesting. Unfortunately the YRC ( Holland) time severely affects my pension amounts as I will draw a little less than 1/2 of what you will actually I will receive about 44% of that amount. For some time I have realized the difference. Unfortunately there are thousands that have no idea how bad it has hurt them. I have said this many times and will say again “ Yellow is the gift that keeps on giving.” Very sad that even in retirement away from the company you will receive a monthly reminder of the benefits you have lost.I guess I should have finished explaining how the pension works in Central States, so here it goes.

What ever amount is contributed for the calendar year (Jan. 1 thru Dec.31) in your behalf will give you 1% of that total per month when you retire.

So, if you have the maximum contribution credits for that calendar year (52-weeks X 5-days a week = 260-days), you would multiply that total by $68.40 (daily contribution rate). That total would be $17,784.00 for that calendar year. So, 1% of that would give you $177.84 a month for that year when you retire. Ten years at that rate would be $1778.40 a month, twenty would be $3556.80 a month, etc., etc…….

**You must have five full contributory years to be vested to get anything.

**You must have at least 90-days credit in a calendar year (I think it is) to get anything for that calendar year.

**You must be 62 or older to draw the full amount. Provided you have at least 20-years in, you can retire as early as 57- years old. But every year you are short of age 62 is a 6% penalty. So if you retired at 57-years old, you would only draw 70% of the maximum.

If you have any other questions, feel free to ask and I will try to answer them my friend!!!

I'm not sure exactly how the 90 days work but you do get credit if you work less. I signed my retirement paperwork at the union hall yesterday with my official retirement date being February 29, 2024. The leap year just seemed appropriate to me. Anyway, my pension estimate increased with me working two months into 2024. Just saying brother. Oh, it is all figured at $68.40 a day/tour. God bless the Y!You must have at least 90-days credit in a calendar year (I think it is) to get anything for that calendar year.

22 years at age 60 is $3,050.00 for dokman.

Last edited:

Congrats on the retirement my friend.I'm not sure exactly how the 90 days work but you do get credit if you work less. I signed my retirement paperwork at the union hall yesterday with my official retirement date being February 29, 2024. The leap year just seemed appropriate to me. Anyway, my pension estimate increased with me working two months into 2024. Just saying brother. Oh, it is all figured at $68.40 a day/tour. God bless the Y!

22 years at age 60 is $3,050.00 for dokman.

Your next important task after Feb will be to find a good leather recliner that the up and down buttons are easy to reach, you don't want to reach too far.

Glad you are getting that much for 22 years.I'm not sure exactly how the 90 days work but you do get credit if you work less. I signed my retirement paperwork at the union hall yesterday with my official retirement date being February 29, 2024. The leap year just seemed appropriate to me. Anyway, my pension estimate increased with me working two months into 2024. Just saying brother. Oh, it is all figured at $68.40 a day/tour. God bless the Y!

22 years at age 60 is $3,050.00 for dokman.

- Credits

- 584

Congrats and on 2/29/24, remember I was the first to welcome you to the six Saturdays and one Sunday a week club. Our moto's is nothing but long weekends in our future!!!I'm not sure exactly how the 90 days work but you do get credit if you work less. I signed my retirement paperwork at the union hall yesterday with my official retirement date being February 29, 2024. The leap year just seemed appropriate to me. Anyway, my pension estimate increased with me working two months into 2024. Just saying brother. Oh, it is all figured at $68.40 a day/tour. God bless the Y!

22 years at age 60 is $3,050.00 for dokman.

I have a close friend who retired from YELLOW, Mariette GA, 17 months ago. He had 22yrs 4 months contributed to CSPF. He retired at full retirement age, 66 and 4 months, and he gets just over $1,300. The company that keeps on taking.Glad you are getting that much for 22 years.

Brother SOR, when I researched whether to retire early, before 62, my full pension retirement age, I kept doing the math on my guaranteed income vs my net pay from the last 3 years. My net income for this year, 2023, is 56,568. That works out to $4,903 a month. That is in close to my net income for the last 3 years. My wife hasn't worked (at a paying job

I'm in Central Pennsylvania at age 62 mine will be $4,620 plus my RIP plan of 1987 should have around $300,000 in it. SS will be around $2,000 a month my wife's SS will be around the same plus her government pension (i have no idea what she has in it) healthcare will be around $140 a month for both of us (government plan) Hopefully all the stars align & this becomes fact....Brother SOR, when I researched whether to retire early, before 62, my full pension retirement age, I kept doing the math on my guaranteed income vs my net pay from the last 3 years. My net income for this year, 2023, is 56,568. That works out to $4,903 a month. That is in close to my net income for the last 3 years. My wife hasn't worked (at a paying job) in 8 years and we live well. My pension is $3,000 and my SS will be $2,100 in 2 years, my wife SS (63yrs) will be $1,000. So my guaranteed income will be $6,100 vs $4,900 now. I just couldn't see working 20 months to receive an extra $500 from CSPF. I will have to pay $359 X 2 =$718 for health insurance. But I just can't see not retiring early. I mention this because I see we are about the same age and so our healthiest years are are retiring quickly. Soon we will be in our 70's and not as healthy. Just how I'm looking at life brother.